基于熵理论的企业财务危机管理研究 ——以沪深ST上市公司为例

浙江财经学院硕士学位论文6摘要所谓财务危机是指企业财务活动处于失控状态或遭受严重挫折的危险与紧急状态,是企业盈利能力和偿付能力实质性削弱,企业趋于破产等困难处境的总称,是企业财务失衡、紧张和恶化的外在表现。财务危机本身存在一个由潜伏、发展以至最终爆发的阶段性特征,是一个动态过程。面对“优胜劣汰,适者生存”的市场竞争,我国上市公司的财务状况面临着前所未有的巨大冲击。鉴于此,每一家上市公司迫切需要建立一套能预先防范财务危机,诊断危机并有效处理财务危机的管理系统,来帮助企业避开和化解可能出现的财务危机。目前虽然已有一些举措来应对财务危机,也出现了众多财务危机预警理论来指导财务危机管理的实施,但这些成...

相关推荐

-

建筑工程投标文件范本-(格式)VIP免费

2024-11-22 48

2024-11-22 48 -

疾病预防控制中心招标文件VIP免费

2025-01-09 50

2025-01-09 50 -

体育健身中心施工招标文件VIP免费

2025-01-09 32

2025-01-09 32 -

江西丰城电厂及广东从化事故案例分析VIP免费

2025-03-04 7

2025-03-04 7 -

钢结构节点图集CAD版(可编辑)VIP免费

2025-03-04 20

2025-03-04 20 -

[青岛]精品工程亮点做法图片集(130页)VIP免费

2025-03-04 12

2025-03-04 12 -

外墙外保温工程技术规程JGJ144-2019VIP免费

2025-03-04 11

2025-03-04 11 -

地铁停车场施工组织设计VIP免费

2025-03-04 14

2025-03-04 14 -

项目建设安全管理流程图汇编VIP免费

2025-03-04 34

2025-03-04 34 -

特训班学习心得VIP免费

2025-03-04 10

2025-03-04 10

作者详情

相关内容

-

[青岛]精品工程亮点做法图片集(130页)

分类:行业资料

时间:2025-03-04

标签:建筑工程、精品工程、细部节点做法、亮点做法

格式:PPT

价格:5 积分

-

外墙外保温工程技术规程JGJ144-2019

分类:行业资料

时间:2025-03-04

标签:外墙保温、工程、规范

格式:ZIP

价格:2 积分

-

地铁停车场施工组织设计

分类:行业资料

时间:2025-03-04

标签:地铁、场段、施工组织设计

格式:DOCX

价格:3 积分

-

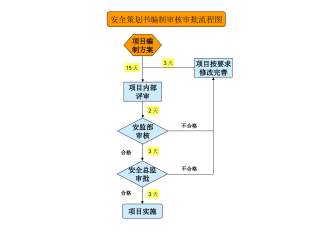

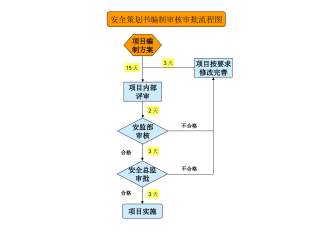

项目建设安全管理流程图汇编

分类:行业资料

时间:2025-03-04

标签:安全管理、流程图

格式:PPT

价格:1 积分

-

特训班学习心得

分类:行业资料

时间:2025-03-04

标签:拓展培训、结构化思考、培训、心得体会

格式:DOCX

价格:1 积分