我国制造业企业所得税负担研究—来自我国上市公司的样本

浙江财经学院硕士学位论文摘要世界经济发展历史表明,一国或某一地区制造业的发展状况能在很大程度上体现其经济的发展情况。美、日、欧等发达国家的综合国力之所以强大,重要特征之一就是拥有世界一流的制造业。作者对我国的制造业比较感兴趣,因为我国是制造业大国但是我国的制造业产业层次低、技术创新弱、在国外市场上相对来讲缺乏很强的竞争力等。此外,税收又是国家宏观调控的重要杠杆,企业所得税负担问题是我国当前经济理论界十分关注的重大课题。优化税负水平与税负结构也是税收政策制定和修正的一个重要内容。但是企业所得税的名义负担与实际负担往往是不一致的,通过对制造业企业所得税实际税收负担的追踪调查,准确把握我国目前制造业...

相关推荐

-

建筑工程投标文件范本-(格式)VIP免费

2024-11-22 48

2024-11-22 48 -

疾病预防控制中心招标文件VIP免费

2025-01-09 50

2025-01-09 50 -

体育健身中心施工招标文件VIP免费

2025-01-09 32

2025-01-09 32 -

江西丰城电厂及广东从化事故案例分析VIP免费

2025-03-04 7

2025-03-04 7 -

钢结构节点图集CAD版(可编辑)VIP免费

2025-03-04 20

2025-03-04 20 -

[青岛]精品工程亮点做法图片集(130页)VIP免费

2025-03-04 12

2025-03-04 12 -

外墙外保温工程技术规程JGJ144-2019VIP免费

2025-03-04 11

2025-03-04 11 -

地铁停车场施工组织设计VIP免费

2025-03-04 14

2025-03-04 14 -

项目建设安全管理流程图汇编VIP免费

2025-03-04 34

2025-03-04 34 -

特训班学习心得VIP免费

2025-03-04 10

2025-03-04 10

作者详情

相关内容

-

[青岛]精品工程亮点做法图片集(130页)

分类:行业资料

时间:2025-03-04

标签:建筑工程、精品工程、细部节点做法、亮点做法

格式:PPT

价格:5 积分

-

外墙外保温工程技术规程JGJ144-2019

分类:行业资料

时间:2025-03-04

标签:外墙保温、工程、规范

格式:ZIP

价格:2 积分

-

地铁停车场施工组织设计

分类:行业资料

时间:2025-03-04

标签:地铁、场段、施工组织设计

格式:DOCX

价格:3 积分

-

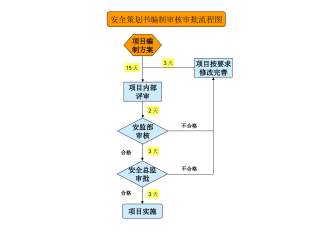

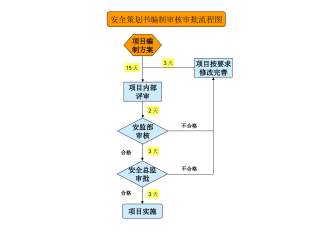

项目建设安全管理流程图汇编

分类:行业资料

时间:2025-03-04

标签:安全管理、流程图

格式:PPT

价格:1 积分

-

特训班学习心得

分类:行业资料

时间:2025-03-04

标签:拓展培训、结构化思考、培训、心得体会

格式:DOCX

价格:1 积分