基于FFT的Regime-Switching指数Lévy模型的期权定价

浙江财经学院硕士学位论文I摘要①期权作为一种金融衍生品投资工具,是市场经济发展到高级阶段的产物。随着商品交易风险和市场不确定因素的增加,期权作为一种有效的套期保值和防范风险的手段,其应用已日趋广泛。期权价格反映的是期权的买卖双方对某一权利作出的价值判断,但我们很难从市场中直接得到期权价格,因此期权定价一直是金融工程中的一个重要课题。在过去的30多年里,学术工作者和实际操作者对期权定价做出了许多的尝试和贡献,具有划时代的意义的突破性进展是Black和Scholes(1973)年提出的BS期权定价模型,尽管BS期权定价模型在期权定价方面取得了很大的成功,但这个纯对数正态模型却不能反映以下三种经济现...

相关推荐

-

建筑工程投标文件范本-(格式)VIP免费

2024-11-22 48

2024-11-22 48 -

疾病预防控制中心招标文件VIP免费

2025-01-09 50

2025-01-09 50 -

体育健身中心施工招标文件VIP免费

2025-01-09 32

2025-01-09 32 -

江西丰城电厂及广东从化事故案例分析VIP免费

2025-03-04 7

2025-03-04 7 -

钢结构节点图集CAD版(可编辑)VIP免费

2025-03-04 20

2025-03-04 20 -

[青岛]精品工程亮点做法图片集(130页)VIP免费

2025-03-04 12

2025-03-04 12 -

外墙外保温工程技术规程JGJ144-2019VIP免费

2025-03-04 11

2025-03-04 11 -

地铁停车场施工组织设计VIP免费

2025-03-04 14

2025-03-04 14 -

项目建设安全管理流程图汇编VIP免费

2025-03-04 34

2025-03-04 34 -

特训班学习心得VIP免费

2025-03-04 10

2025-03-04 10

作者详情

相关内容

-

[青岛]精品工程亮点做法图片集(130页)

分类:行业资料

时间:2025-03-04

标签:建筑工程、精品工程、细部节点做法、亮点做法

格式:PPT

价格:5 积分

-

外墙外保温工程技术规程JGJ144-2019

分类:行业资料

时间:2025-03-04

标签:外墙保温、工程、规范

格式:ZIP

价格:2 积分

-

地铁停车场施工组织设计

分类:行业资料

时间:2025-03-04

标签:地铁、场段、施工组织设计

格式:DOCX

价格:3 积分

-

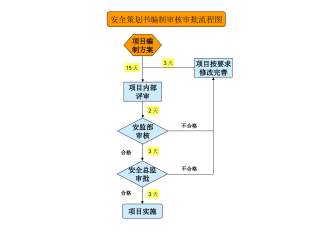

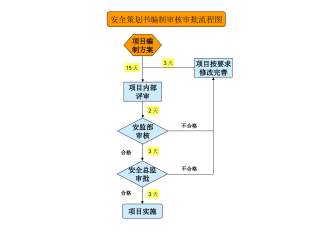

项目建设安全管理流程图汇编

分类:行业资料

时间:2025-03-04

标签:安全管理、流程图

格式:PPT

价格:1 积分

-

特训班学习心得

分类:行业资料

时间:2025-03-04

标签:拓展培训、结构化思考、培训、心得体会

格式:DOCX

价格:1 积分