金融机构与物流企业在存货质押业务中的激励研究

I摘要随着越来越多的中小企业通过存货质押运作获得了银行贷款,改善资金链。同时,许多知名的物流企业和金融机构也因开展存货质押业务实现了新的利润增长,存货质押在我国已引起了广泛的关注。与传统信贷业务相比,存货质押业务引入了新的参与主体——物流企业作为监督者,在一定程度上改善了金融机构与融资企业间的信息不对称问题。但金融机构往往为了实现自身收益最大化、风险最小化,而通过契约最大限度地将风险转嫁给物流企业,加之金融机构对物流企业的激励不足,导致物流企业进行存货质押业务的积极性不断降低,即由于金融机构与物流企业激励机制的不完善制约着存货质押业务的发展。因此,本研究以存货质押业务中金融机构与物流企业的激励...

相关推荐

-

建筑工程投标文件范本-(格式)VIP免费

2024-11-22 48

2024-11-22 48 -

疾病预防控制中心招标文件VIP免费

2025-01-09 50

2025-01-09 50 -

体育健身中心施工招标文件VIP免费

2025-01-09 32

2025-01-09 32 -

江西丰城电厂及广东从化事故案例分析VIP免费

2025-03-04 7

2025-03-04 7 -

钢结构节点图集CAD版(可编辑)VIP免费

2025-03-04 20

2025-03-04 20 -

[青岛]精品工程亮点做法图片集(130页)VIP免费

2025-03-04 13

2025-03-04 13 -

外墙外保温工程技术规程JGJ144-2019VIP免费

2025-03-04 11

2025-03-04 11 -

地铁停车场施工组织设计VIP免费

2025-03-04 14

2025-03-04 14 -

项目建设安全管理流程图汇编VIP免费

2025-03-04 34

2025-03-04 34 -

特训班学习心得VIP免费

2025-03-04 10

2025-03-04 10

相关内容

-

[青岛]精品工程亮点做法图片集(130页)

分类:行业资料

时间:2025-03-04

标签:建筑工程、精品工程、细部节点做法、亮点做法

格式:PPT

价格:5 积分

-

外墙外保温工程技术规程JGJ144-2019

分类:行业资料

时间:2025-03-04

标签:外墙保温、工程、规范

格式:ZIP

价格:2 积分

-

地铁停车场施工组织设计

分类:行业资料

时间:2025-03-04

标签:地铁、场段、施工组织设计

格式:DOCX

价格:3 积分

-

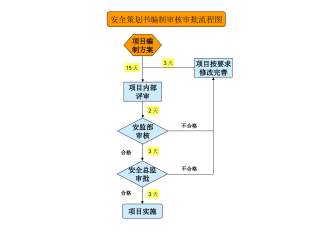

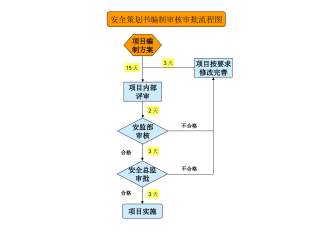

项目建设安全管理流程图汇编

分类:行业资料

时间:2025-03-04

标签:安全管理、流程图

格式:PPT

价格:1 积分

-

特训班学习心得

分类:行业资料

时间:2025-03-04

标签:拓展培训、结构化思考、培训、心得体会

格式:DOCX

价格:1 积分