审计行业专门化战略与审计质量 ——基于不同客户规模和事务所规模研究

浙江财经学院硕士学位论文I摘要2006年新审计准则确立了“风险导向审计准则”,2007年中注协印发的《关于推动事务所做大做强的意见》以及2009年国务院办公厅转发财政部的《关于加快发展我国注册会计师行业的若干意见》(即国办56号文件)等,这都在客观上为我国会计师事务所实行行业专门化经营提供了有利条件。审计师的行业专门化经营是相对于规模化发展而言另一种行之有效的发展方式,其实质是事务所一种内涵式的“做专”策略。当前国外对于审计师行业专长领域的研究比较深入和广泛,国内在近几年来研究也开始升温。国内现阶段行业专长的研究多是针对其本身的理论综述、行业专长同审计质量、审计定价及其绩效方面的研究,其中审计...

相关推荐

-

建筑工程投标文件范本-(格式)VIP免费

2024-11-22 48

2024-11-22 48 -

疾病预防控制中心招标文件VIP免费

2025-01-09 50

2025-01-09 50 -

体育健身中心施工招标文件VIP免费

2025-01-09 32

2025-01-09 32 -

江西丰城电厂及广东从化事故案例分析VIP免费

2025-03-04 7

2025-03-04 7 -

钢结构节点图集CAD版(可编辑)VIP免费

2025-03-04 20

2025-03-04 20 -

[青岛]精品工程亮点做法图片集(130页)VIP免费

2025-03-04 12

2025-03-04 12 -

外墙外保温工程技术规程JGJ144-2019VIP免费

2025-03-04 11

2025-03-04 11 -

地铁停车场施工组织设计VIP免费

2025-03-04 14

2025-03-04 14 -

项目建设安全管理流程图汇编VIP免费

2025-03-04 34

2025-03-04 34 -

特训班学习心得VIP免费

2025-03-04 10

2025-03-04 10

作者详情

相关内容

-

[青岛]精品工程亮点做法图片集(130页)

分类:行业资料

时间:2025-03-04

标签:建筑工程、精品工程、细部节点做法、亮点做法

格式:PPT

价格:5 积分

-

外墙外保温工程技术规程JGJ144-2019

分类:行业资料

时间:2025-03-04

标签:外墙保温、工程、规范

格式:ZIP

价格:2 积分

-

地铁停车场施工组织设计

分类:行业资料

时间:2025-03-04

标签:地铁、场段、施工组织设计

格式:DOCX

价格:3 积分

-

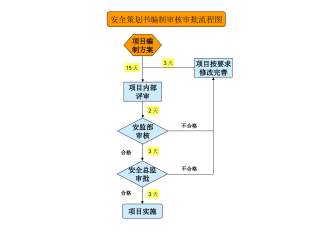

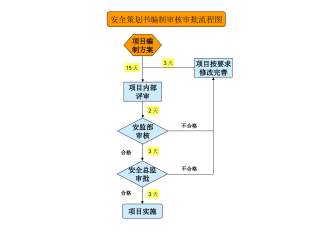

项目建设安全管理流程图汇编

分类:行业资料

时间:2025-03-04

标签:安全管理、流程图

格式:PPT

价格:1 积分

-

特训班学习心得

分类:行业资料

时间:2025-03-04

标签:拓展培训、结构化思考、培训、心得体会

格式:DOCX

价格:1 积分