我国金融工具准则持续全面国际趋同的影响及策略研究

浙江财经学院硕士学位论文5摘要百年一遇的金融海啸把金融工具准则推到了风口浪尖。与此同时,国际会计准则理事会和美国财务会计准则委员会作为国际上最有影响力的两个会计准则机构也备受政治压力和舆论指责。此后,这两个会计准则机构联手启动了“金融工具确认和计量”的改进项目,致力于降低金融工具复杂性,提高财务报告质量。2009年11月,国际会计准则理事会发布了国际财务报告准则第九号准则《金融工具:分类和计量》和《金融工具:摊余成本与减值(征求意见稿)》,标志着金融工具准则改进取得了阶段性成果。金融危机爆发以后,二十国集团峰会、金融稳定理事会倡议建立全球统一的高质量会计准则,这将会计准则问题提到了前所未有的高...

相关推荐

-

建筑工程投标文件范本-(格式)VIP免费

2024-11-22 48

2024-11-22 48 -

疾病预防控制中心招标文件VIP免费

2025-01-09 50

2025-01-09 50 -

体育健身中心施工招标文件VIP免费

2025-01-09 32

2025-01-09 32 -

江西丰城电厂及广东从化事故案例分析VIP免费

2025-03-04 7

2025-03-04 7 -

钢结构节点图集CAD版(可编辑)VIP免费

2025-03-04 20

2025-03-04 20 -

[青岛]精品工程亮点做法图片集(130页)VIP免费

2025-03-04 12

2025-03-04 12 -

外墙外保温工程技术规程JGJ144-2019VIP免费

2025-03-04 11

2025-03-04 11 -

地铁停车场施工组织设计VIP免费

2025-03-04 14

2025-03-04 14 -

项目建设安全管理流程图汇编VIP免费

2025-03-04 34

2025-03-04 34 -

特训班学习心得VIP免费

2025-03-04 10

2025-03-04 10

作者详情

相关内容

-

[青岛]精品工程亮点做法图片集(130页)

分类:行业资料

时间:2025-03-04

标签:建筑工程、精品工程、细部节点做法、亮点做法

格式:PPT

价格:5 积分

-

外墙外保温工程技术规程JGJ144-2019

分类:行业资料

时间:2025-03-04

标签:外墙保温、工程、规范

格式:ZIP

价格:2 积分

-

地铁停车场施工组织设计

分类:行业资料

时间:2025-03-04

标签:地铁、场段、施工组织设计

格式:DOCX

价格:3 积分

-

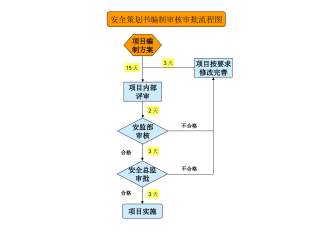

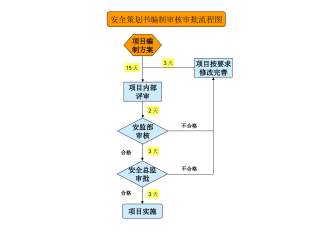

项目建设安全管理流程图汇编

分类:行业资料

时间:2025-03-04

标签:安全管理、流程图

格式:PPT

价格:1 积分

-

特训班学习心得

分类:行业资料

时间:2025-03-04

标签:拓展培训、结构化思考、培训、心得体会

格式:DOCX

价格:1 积分