我国资本利得课税制度研究

浙江财经学院硕士学位论文I摘要资本利得税自诞生以来就是一个充满争议的税种,就连美国这种税收制度比较完善的发达国家,对资本利得税征收也是一直争论不休。我国的资本市场经过这么多年的发展已经有了长足的进步,但是最近几年进行股份制改革产生的大小非问题、房地产市场过度繁荣问题以及新股上市产生的限售股解禁上市流通等问题,致使社会收入分配两级化进一步严重,引起普通劳动人民的强烈不满,开征资本利得税,利用资本利得税的宏观调控作用来解决上述问题越来越受到人们的重视。本文采用理论研究和实证研究相结合的方法,结合国内外有关资本利得的概念重新定义了资本利得税,对资本利得税的内涵进行了新的阐述和分析。重点研究了资本利得...

相关推荐

-

建筑工程投标文件范本-(格式)VIP免费

2024-11-22 48

2024-11-22 48 -

疾病预防控制中心招标文件VIP免费

2025-01-09 50

2025-01-09 50 -

体育健身中心施工招标文件VIP免费

2025-01-09 32

2025-01-09 32 -

江西丰城电厂及广东从化事故案例分析VIP免费

2025-03-04 7

2025-03-04 7 -

钢结构节点图集CAD版(可编辑)VIP免费

2025-03-04 20

2025-03-04 20 -

[青岛]精品工程亮点做法图片集(130页)VIP免费

2025-03-04 12

2025-03-04 12 -

外墙外保温工程技术规程JGJ144-2019VIP免费

2025-03-04 11

2025-03-04 11 -

地铁停车场施工组织设计VIP免费

2025-03-04 14

2025-03-04 14 -

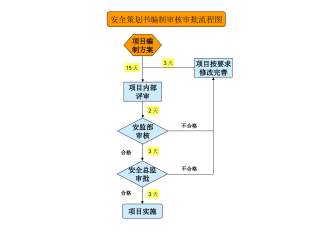

项目建设安全管理流程图汇编VIP免费

2025-03-04 34

2025-03-04 34 -

特训班学习心得VIP免费

2025-03-04 10

2025-03-04 10

作者详情

相关内容

-

[青岛]精品工程亮点做法图片集(130页)

分类:行业资料

时间:2025-03-04

标签:建筑工程、精品工程、细部节点做法、亮点做法

格式:PPT

价格:5 积分

-

外墙外保温工程技术规程JGJ144-2019

分类:行业资料

时间:2025-03-04

标签:外墙保温、工程、规范

格式:ZIP

价格:2 积分

-

地铁停车场施工组织设计

分类:行业资料

时间:2025-03-04

标签:地铁、场段、施工组织设计

格式:DOCX

价格:3 积分

-

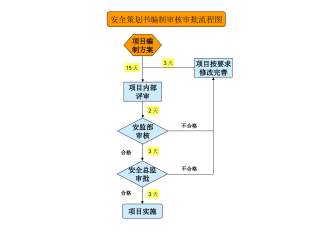

项目建设安全管理流程图汇编

分类:行业资料

时间:2025-03-04

标签:安全管理、流程图

格式:PPT

价格:1 积分

-

特训班学习心得

分类:行业资料

时间:2025-03-04

标签:拓展培训、结构化思考、培训、心得体会

格式:DOCX

价格:1 积分